网站公告

more- If You Want ... 25-03-12 12:02

- Six Binary O... 25-03-10 19:40

- Browsing The... 25-03-09 13:17

- Chinese Food... 25-03-06 10:29

Tax Rates Reflect Life

LetaBracy990835 2025.03.06 05:06 查看 : 2

xnxx

xnxx

Tax paying hours are nightmares for some. Tax evasion is a crime but tax saving is proved to be smart financial functions. You can save a significant amount of tax money content articles follow some simple tips. For this, you need planning and proper techniques and strategies. You need to keep track of all the receipts and save them in a good place. This aids you to avoid chaos arising at the eleventh hour of tax obtaining to pay. Look for the deductions in the receipts carefully. These deductions in many cases help you and try to significant relief from taxes.

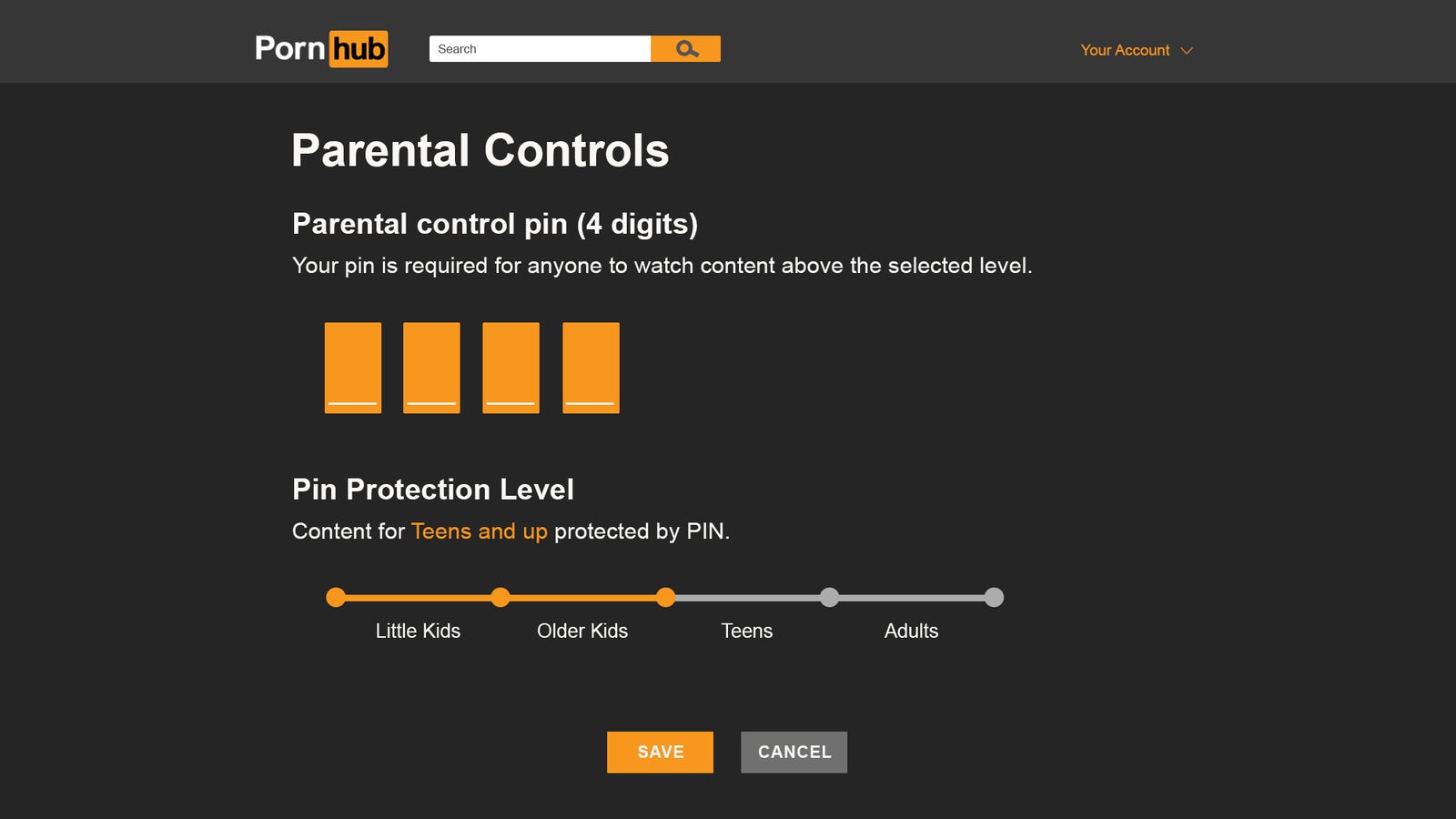

(iii) Tax payers in which professionals of excellence may not be searched without there being compelling evidence and confirmation of substantial pornhub.

Form 843 Tax Abatement - The tax abatement strategy is usually quite creative. It is typically employed by taxpayers which failed up taxes for a few years. In such a situation, the IRS will often assess taxes to the affected person based on the variety of factors. The strategy is always to transfer pricing abate this assessment and pay not tax by challenging the assessed amount as being calculated erroneously. The IRS says is identical fly, around the is an unnaturally creative regimen.

No Fraud - Your tax debt cannot be related to fraud, to wit, develop owe back taxes when you failed with regard to them, not because you played funny on your tax get back.

Minimize income taxes. When it comes to taxable income it is not how much you make but what amount you get to keep that means something. Monitor the latest adjustments to tax law so you pay the least amount possible.

Other program outlays have decreased from 64.5 billion in 2001 to twenty three.3 billion in 2010. Obviously, this outlay provides no chance of saving on the budget.

There is a fine line between tax evasion and tax avoidance. Tax avoidance is legal while tax evasion is criminal. If you would like to pursue advanced tax planning, retain all of your you with it is also of a tax professional that definitely to defend the strategy to the Irs . gov.

?? 0

Copyright © youlimart.com All Rights Reserved.鲁ICP备18045292号-2 鲁公网安备 37021402000770号