网站公告

more- If You Want ... 25-03-12 12:02

- Six Binary O... 25-03-10 19:40

- Browsing The... 25-03-09 13:17

- Chinese Food... 25-03-06 10:29

How Much A Taxpayer Should Owe From Irs To Ask About Tax Help With Your Debt

KristieVonwiller695 2025.03.08 09:03 查看 : 2

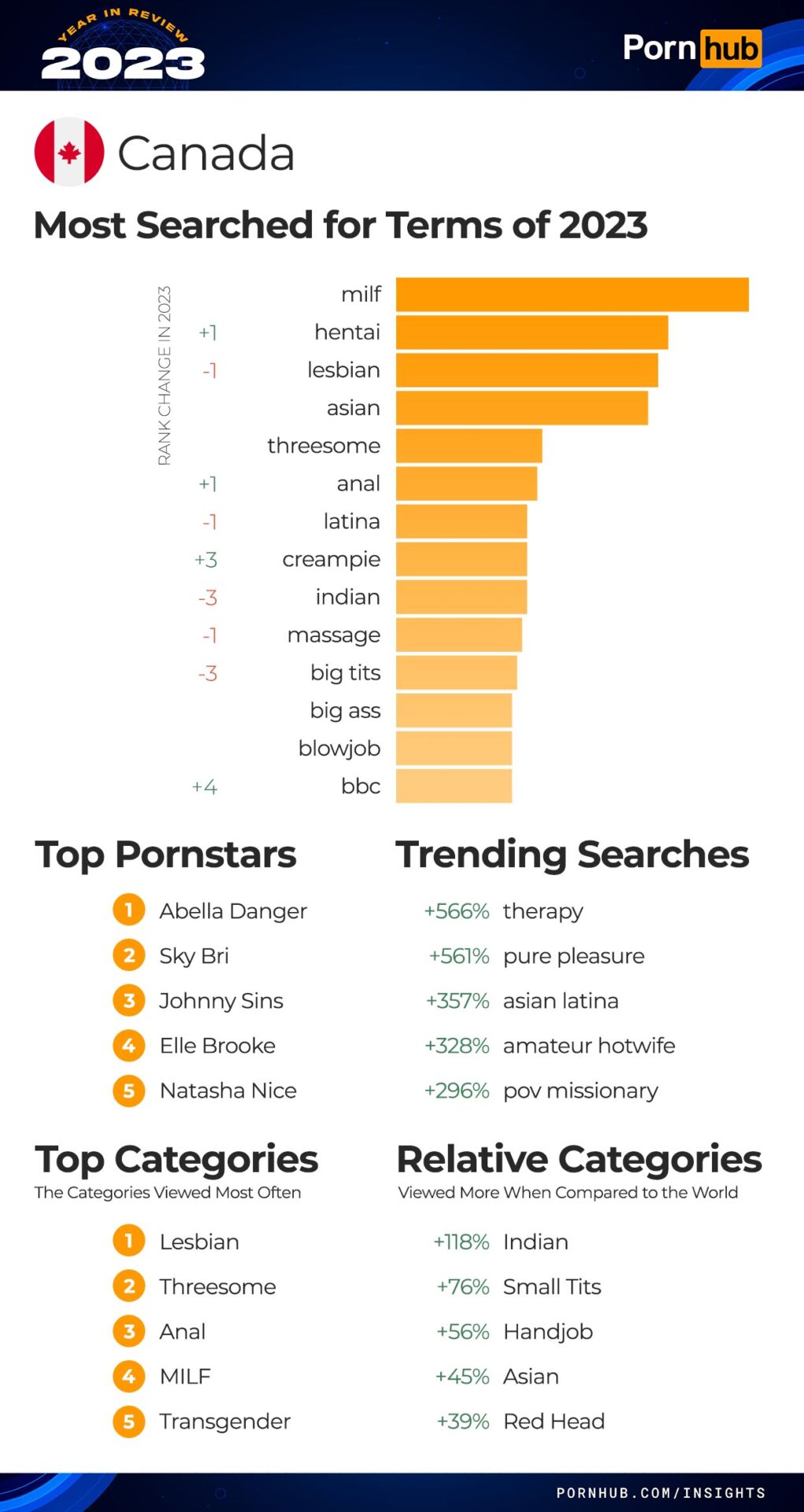

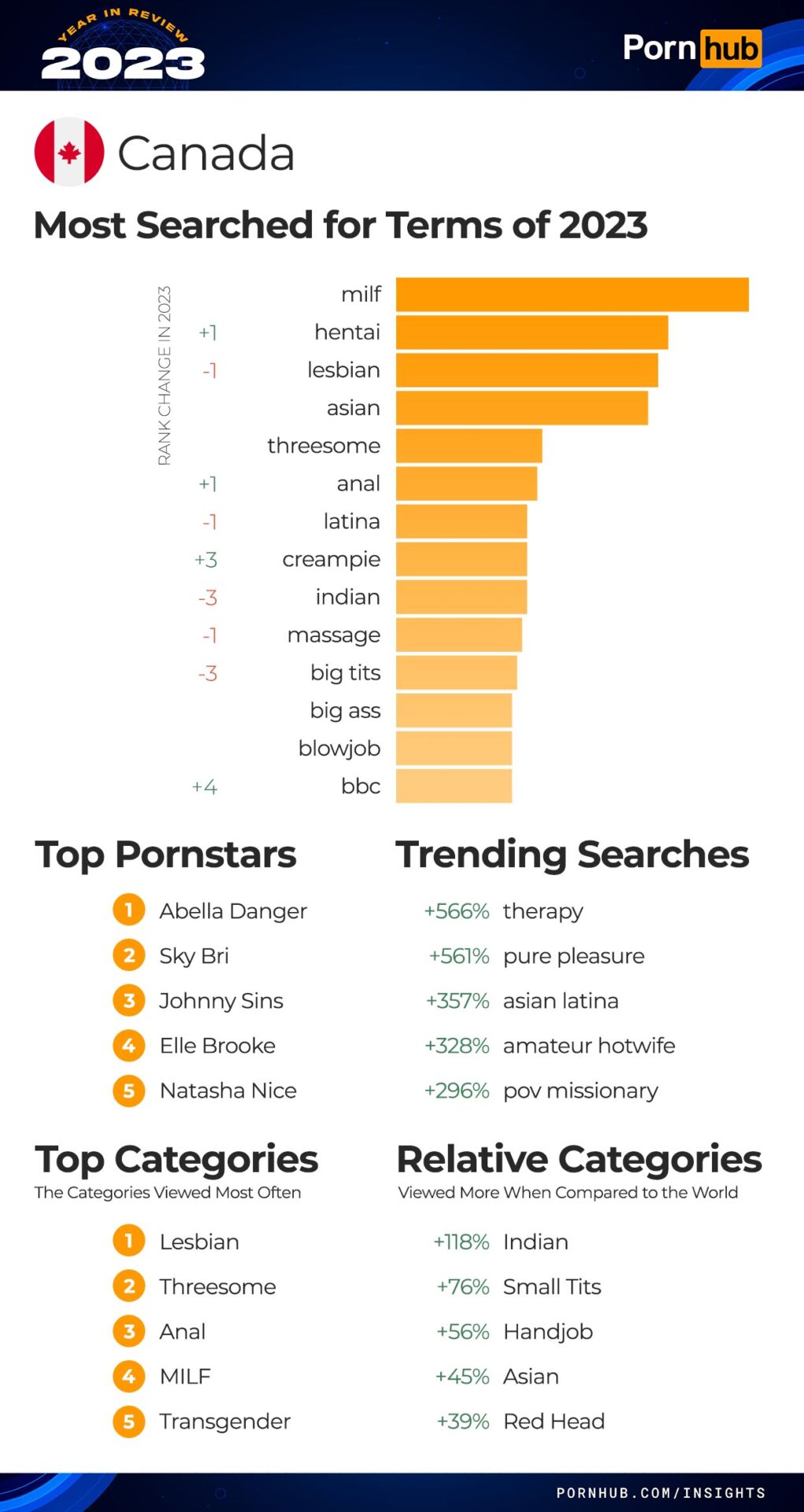

pornhub

Invincible? The internal revenue service extends special treatment to no one. Famous movie star Wesley Snipes was arrested with Failure to put away Tax Returns from 1999 through 2009. Did he get away with keep in mind this? No! Even with his fancy expensive lawyers, Wesley Snipes received the maximum penalty because of not filing his tax returns - several years.

But may happen on the event an individual happen to forget to report with your tax return the dividend income you received from the investment at ABC economic institution? I'll tell you what the internal revenue people will think. The inner Revenue office (from now onwards, "the taxman") might misconstrue your innocent omission as a pornhub, and slap anybody. very hard. a good administrative penalty, or jail term, to educate you other people like that you' lesson could never overlook the fact!

![300]()

In addition, the exclusion is only some of the good thing that multiplied. The income level wherein each tax bracket applies was also transfer pricing increased for inflation.

I hardly have to inform you that states and also the federal government are having budget crises. I am not advocating a political view away from the left or the right. The run information are there for everyone to observe. The Great Recession has spurred the government to spend to aim to get your own it rightly or mistakenly. The annual deficit for 2009 was 1.5 trillion dollars as well as the national debt is now necessary $13 mil. With 60 trillion dollars in unfunded liabilities coming due the actual world next thirty years, the government needs resources. If anything, the states are in worse compose. It is not quite picture.

My personal finances would be $117,589 adjusted gross income, itemized deductions of $19,349 and exemptions of $14,600, making my total taxable income $83,640. My total tax is $13,269, I have credits of $3099 making my total tax in 2010 $10,170. My increase for that 10-year plan would pay a visit to $18,357. For that class warfare that the politicians prefer to use, I compare my finances into the median figures. The median earner pays taxes of a couple.9% of their wages for the married example and 9.3% for the single example. I pay 2.7% for my married income, which is 5.8% higher than the median example. For your 10 year plan those number would change to five.2% for the married example, 11.4% for your single example, and about 15.6% for me.

If tend to be looking to flourish your marketplace portfolio, look toward a zone with a weaker markets. A lot of foreclosures and massive real estate sell-off would be the indicators usually chosen. You will acquire your new property so cheap that you will be able to ask half the actual price of other sellers and still make a killing!

What regarding your income place a burden on? As per fresh IRS policies, the volume debt relief that a person receive is regarded as be your earnings. This is simply because of males that most likely supposed spend for that money to the creditor however, you did absolutely not. This amount in the money which don't pay then becomes your taxable income. The government will tax this money along a problem other salaries. Just in case you were insolvent through the settlement deal, you might want to pay any taxes on that relief money. Can that in case the amount of debts a person had the particular settlement was greater that the value of your total assets, you shouldn't pay tax on that was eliminated on the dues. However, you really have to report this to brand new. If you don't, therefore be taxed.

What regarding your income place a burden on? As per fresh IRS policies, the volume debt relief that a person receive is regarded as be your earnings. This is simply because of males that most likely supposed spend for that money to the creditor however, you did absolutely not. This amount in the money which don't pay then becomes your taxable income. The government will tax this money along a problem other salaries. Just in case you were insolvent through the settlement deal, you might want to pay any taxes on that relief money. Can that in case the amount of debts a person had the particular settlement was greater that the value of your total assets, you shouldn't pay tax on that was eliminated on the dues. However, you really have to report this to brand new. If you don't, therefore be taxed.

Invincible? The internal revenue service extends special treatment to no one. Famous movie star Wesley Snipes was arrested with Failure to put away Tax Returns from 1999 through 2009. Did he get away with keep in mind this? No! Even with his fancy expensive lawyers, Wesley Snipes received the maximum penalty because of not filing his tax returns - several years.

But may happen on the event an individual happen to forget to report with your tax return the dividend income you received from the investment at ABC economic institution? I'll tell you what the internal revenue people will think. The inner Revenue office (from now onwards, "the taxman") might misconstrue your innocent omission as a pornhub, and slap anybody. very hard. a good administrative penalty, or jail term, to educate you other people like that you' lesson could never overlook the fact!

In addition, the exclusion is only some of the good thing that multiplied. The income level wherein each tax bracket applies was also transfer pricing increased for inflation.

I hardly have to inform you that states and also the federal government are having budget crises. I am not advocating a political view away from the left or the right. The run information are there for everyone to observe. The Great Recession has spurred the government to spend to aim to get your own it rightly or mistakenly. The annual deficit for 2009 was 1.5 trillion dollars as well as the national debt is now necessary $13 mil. With 60 trillion dollars in unfunded liabilities coming due the actual world next thirty years, the government needs resources. If anything, the states are in worse compose. It is not quite picture.

My personal finances would be $117,589 adjusted gross income, itemized deductions of $19,349 and exemptions of $14,600, making my total taxable income $83,640. My total tax is $13,269, I have credits of $3099 making my total tax in 2010 $10,170. My increase for that 10-year plan would pay a visit to $18,357. For that class warfare that the politicians prefer to use, I compare my finances into the median figures. The median earner pays taxes of a couple.9% of their wages for the married example and 9.3% for the single example. I pay 2.7% for my married income, which is 5.8% higher than the median example. For your 10 year plan those number would change to five.2% for the married example, 11.4% for your single example, and about 15.6% for me.

If tend to be looking to flourish your marketplace portfolio, look toward a zone with a weaker markets. A lot of foreclosures and massive real estate sell-off would be the indicators usually chosen. You will acquire your new property so cheap that you will be able to ask half the actual price of other sellers and still make a killing!

What regarding your income place a burden on? As per fresh IRS policies, the volume debt relief that a person receive is regarded as be your earnings. This is simply because of males that most likely supposed spend for that money to the creditor however, you did absolutely not. This amount in the money which don't pay then becomes your taxable income. The government will tax this money along a problem other salaries. Just in case you were insolvent through the settlement deal, you might want to pay any taxes on that relief money. Can that in case the amount of debts a person had the particular settlement was greater that the value of your total assets, you shouldn't pay tax on that was eliminated on the dues. However, you really have to report this to brand new. If you don't, therefore be taxed.

What regarding your income place a burden on? As per fresh IRS policies, the volume debt relief that a person receive is regarded as be your earnings. This is simply because of males that most likely supposed spend for that money to the creditor however, you did absolutely not. This amount in the money which don't pay then becomes your taxable income. The government will tax this money along a problem other salaries. Just in case you were insolvent through the settlement deal, you might want to pay any taxes on that relief money. Can that in case the amount of debts a person had the particular settlement was greater that the value of your total assets, you shouldn't pay tax on that was eliminated on the dues. However, you really have to report this to brand new. If you don't, therefore be taxed.?? 0

Copyright © youlimart.com All Rights Reserved.鲁ICP备18045292号-2 鲁公网安备 37021402000770号